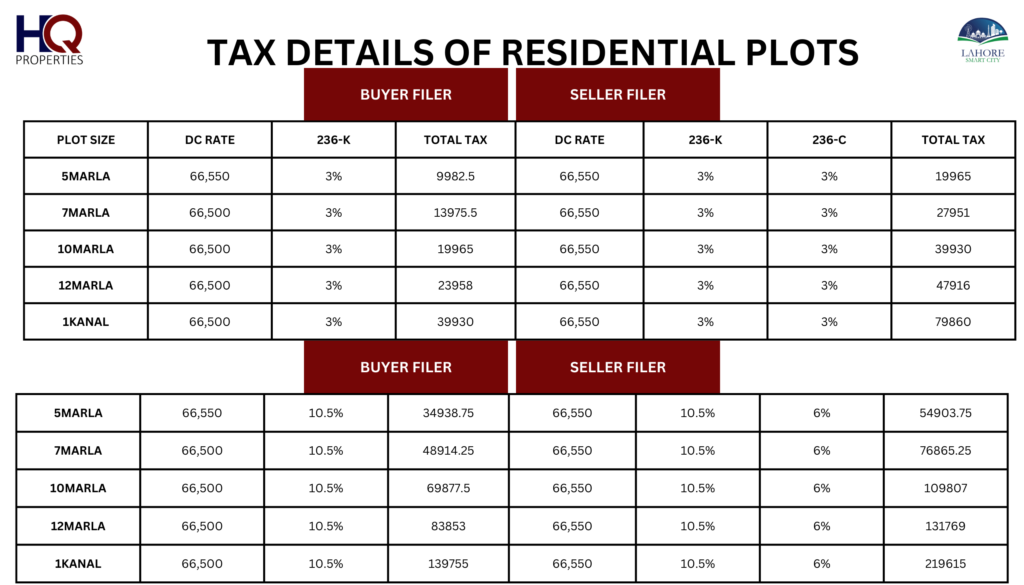

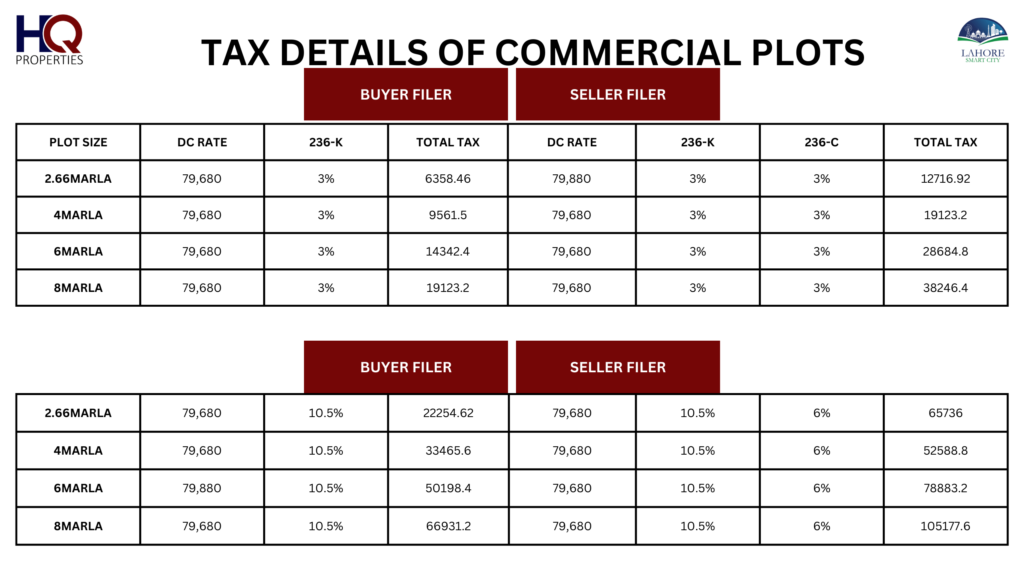

As the real estate landscape evolves in Pakistan, the Lahore Smart City project emerges as a significant development, blending modern amenities with sustainable urban planning. With the rise of such innovative ventures, it becomes essential for both buyers and sellers to understand the tax implications associated with property transactions in Lahore Smart City and Pakistan at large. Here’s a detailed note outlining the buyer and seller taxes applicable in Lahore Smart City and the broader Pakistani real estate market.

The Federal Board of Revenue (FBR) has imposed an advance tax on all investments of all real estate projects. The taxes are made applicable from 31st October 2022.

The investors evidently have many questions regarding this new policy. This article will cover most of these questions and will help you understand how the FBR Advance Tax Policy will be applicable to your investment.

As the term ” Advance Tax” may seem a dreary one, but it’s not! Advance Tax is not a tax being charged separately on real estate properties. The advance tax you’re required to pay now would be later adjusted to your annual income tax.

- Either you buy or sell a property, you’ll have to pay an FBR Advance Tax.

- Tax will also be applicable to the Installments files that have been balloted.

- The files that are not balloted shall not pay the tax yet (but only after the files are balloted).

These amounts are subject to change without notice as per any amendments in law, in the percentage of taxes for filers, non-filers, or in the FBR value of properties.

Get Services of HQ Properties for Lahore Smart City

If you want to get services of any kind pertaining to property management in Lahore Smart City.

Moreover, if you want to invest or are seeking any investment consultancy in Lahore Smart City, we have a successful track record of investments back in 2017, 2018, and 2019 for our domestic as well as overseas clients.

Contact on the given Contact number for services and investment queries in Lahore Smart City.

Overseas and domestic Clients

WhatsApp: 0333 8532226